Our scenarios

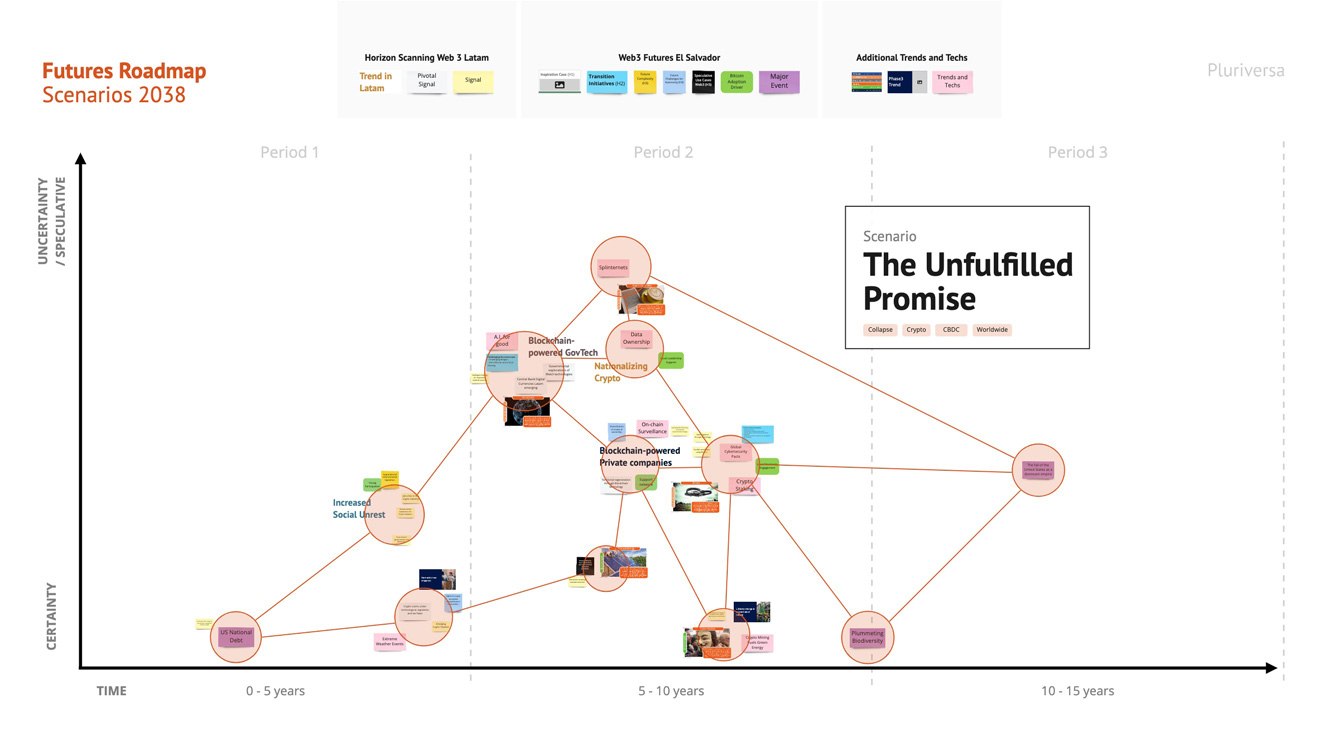

The Unfulfilled Promise - 2038

Scenario overview

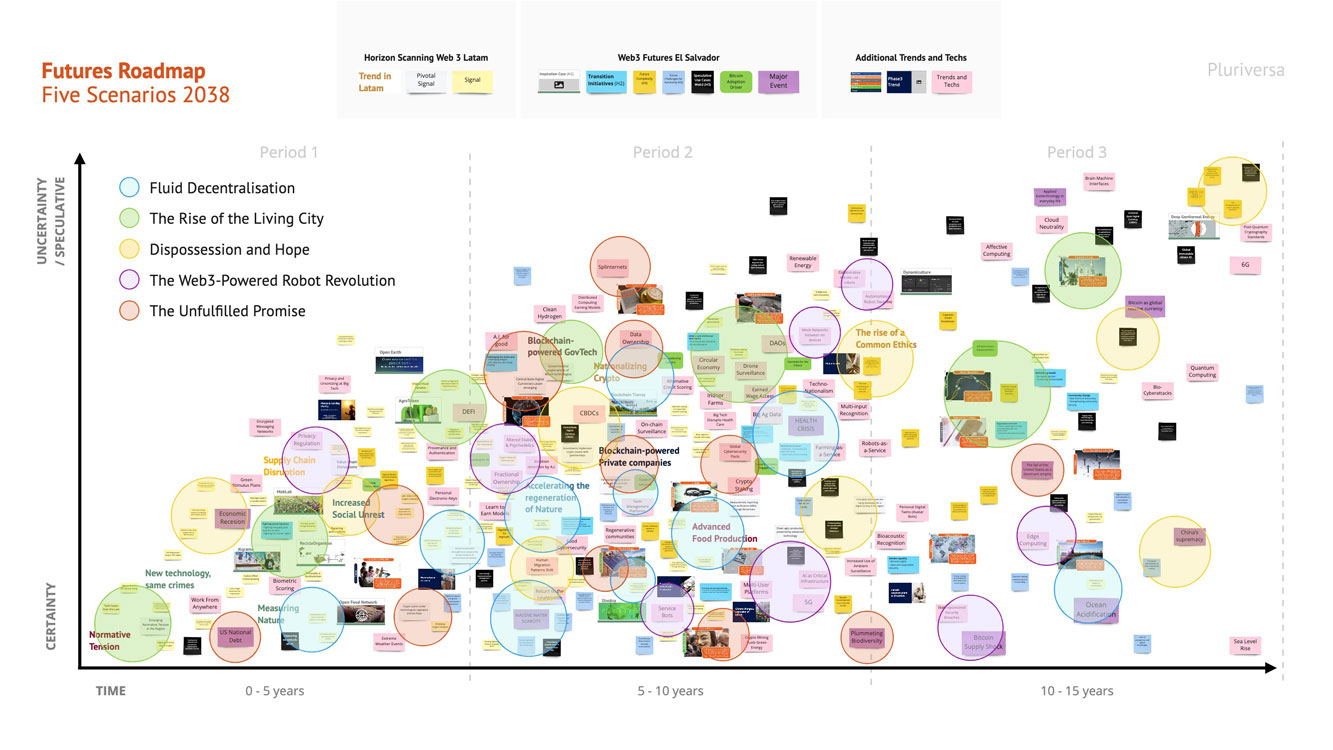

At the beginning of the 30s, the US was highly in debt, and a new economic depression emerged. An unprecedented social upheaval occurred, and people started looking for alternative ways to maintain their purchasing power. Cryptocurrencies were one of the most popular alternatives for risk-takers. The massive crypto adoption also led to crypto fiscal paradises and several decentralized networks competing, where Central Bank Digital Currencies are relevant but still dangerous.

*This scenario was created originally in British English.

-

Web3 Speculative Futures Latam

Sector:

Web3, Bitcoin, Blockchain

Key topics:

Collapse, Crypto, CBDCs, Worldwide

Time horizon:

2038

The Crazy 20s

Between the years 2023 and 2028, Americans emitted an additional 6.8 trillion dollars, and their total internal debt surpassed 40 trillion dollars. To put this number in context, 40 trillion seconds are equivalent to 1.3 million years.

The world fell into darkness. A social upheaval like nothing the world had ever seen occurred right after the American debt default in 2029.

To mitigate the economic impacts of this economic depression, the United States built (again) a wall on the frontier with Mexico. This time the wall works with robot technology to discourage the exodus of Latin American people escaping from the US to their respective countries.

The chaos of seeking a valuable refuge

Like Voltaire prophesized, paper money eventually returns to its intrinsic value: zero.

The impact of the depression on Latin America was disastrous. All the economies turned to alternative forms to preserve their purchasing power. Metals like gold, rhodium, or palladium were on the lists of traditional investors. However, the real protagonist of the “monetary salvation” were cryptocurrencies; they had already made thousands of speculators and techno-optimists millionaires. Lots of scams and bankruptcies occurred under the name of cryptocurrencies, but people didn’t seem to mind. After all, the economic turmoil was such that they only thought of saving themselves.

Crypto enthusiasts celebrated the destruction of fiat money, and they fantasized about the luxury cars that they would be able to acquire. Those unable to get rid of traditional money fell into extreme poverty.

Cryptocurrencies were adopted globally and in a traumatic way. Nonetheless, the world continued to leave behind the ruins of past economies under a new and tokenized macroeconomy.

Crypto frivolity

Despite the economic depression, video games based on Non-Fungible-Tokens (NFTs) continue to be one of the fastest-growing industries in Latin America, maintaining their Proof-of-Game (PoG) system.

Every day, millions of players of all ages in these gamified economies engage in addictive interactions and fantastic adventures to win tokenized battles and capture NFT characters. They can later redeem them in the real world for money or pay directly with them for everyday expenses.

Some banks even receive NFTs as credit collateral. The most desired ones are those from “Supatrupa and Friends”, a renowned video game and cartoon character that is a hit among all ages. Living by playing and playing for a living seemed like the life dream of any Latin American teenager.

The problems did not take long to arrive. Many communities watched in horror how its culture, language, customs, and local economies deteriorated, but what is worst, one young generation was entirely ruined by colorful NFTs. The young ones do not want to study or work for the community’s needs, creating an atomized social crisis.

Communities took legal action against videogame companies accusing them of neo-colonialist practices. Still, their economies were so strong that they could evade their charges by bribing the judges with limited edition NFTs, where Supatrupa collaborates with JayMia, an ultra-famous Costa Rican singer.

Crypto Fiscal Paradises

With confidence in governments eroded, many companies found ways to avoid taxes by putting their crypto-assets in crypto fiscal paradises. This bothers governments worldwide, as they have been unable to create a legal framework that limits the use of crypto and establishes how it should fit inside the global tax system.

Each country has specific interests, making it difficult to work on the required normativity. However, the main challenge is not a political one but a legal one. To legislators, it has been impossible to rule over cryptocurrencies because the technology goes faster than the norms created or modified.

During these 15 years, Latin America has not been indifferent to the global trend of population decline. Theirs has been at a slower rate, but the population is getting old. The pension system collapsed due to the economic depression, and there were insufficient funds to guarantee everyone their retirement. Governments tried to redistribute resources throughout the transition to cryptocurrencies, but the elites protested and found a way to evade their money.

Crypto fiscal paradises offer pension saving plans, causing a collapse of the pension funds of many countries. This is legal as it protects private property and the life savings of an elite unwilling to make a fair contribution.

These new form of fiscal paradises is nowhere near disappearing, and quite the opposite is occurring. Many countries have started to promote themselves as crypto-friendly.

Splinternet

The promise of decentralization using Web3 technologies did not generate greater cooperation. On the contrary, nationalist interests and protectionism were strengthened. Younger generations do not remember when the Internet operated under the protocol of the World Wide Web and felt like a single and unified global network.

There are currently many decentralized networks, each with a specific security protocol. This has resulted in intense competition between some networks to attract certain users.

The different networks are segregated and divided. Some are very efficient but only open to the wealthy. Others have less computing power but more open access; some are technocratic and hyper-surveillance cyberspaces.

Latin American countries don’t know which way to go. Free market laws dictate that competition between different networks is good and can help innovation surge, but the opposite seems to occur in practice. A technological stagnation occurs in terms of this splinternet and Web3.

The different networks have slowly become a political issue. Powerful countries have gotten together in the same network, leaving behind small Latin American countries with less technological power.

Nationalizing Crypto

The world experienced a surge in cryptocurrencies, both private and backed by governments. Those with the best profitability and features were adopted faster and became the most relevant ones. Unfortunately, that was not the case with the Digital Guaraní, Paraguay’s central bank currency.

Due to the lack of technological power, the new Paraguayan digital currency could not compete with other more robust digital currencies from powerful countries. The country had to adopt the lesser evil of all: the Brazilian Digital Real. This situation revived old resentments between the people of the two countries.

Brazil did not miss the opportunity to exert some colonial power over the small Paraguayan nation. A similar situation is occurring in Bolivia due to asymmetric trade policies. Many fear the Brazilian government will attempt to annex these two nations to its territory.

Pro-democracy and human rights advocates fill the streets of the main Brazilian cities. They consider everything an insult to the brotherhood of Latin American countries. However, the Brazilian extreme right defends the government’s expansionist interests, creating a barrier that divides the country.

Having the support of BRICSET countries (Brazil, Russia, India, China, South Africa, Egypt, and Turkey), it seems that the fate of Paraguay and Bolivia is inevitable.

Blockchain Governance

A group of countries focused on solving some of the century’s most pressing political issues have decided to implement decentralized government mechanisms to help them make decisions without using official government institutions. Many countries have asked for this, especially those in the global south that don’t see themselves represented by their political class and suffer the price of corruption.

This experiment has mixed results. Some countries are doing wonderfully, while others have had difficulty using decentralized government mechanisms to govern based on Blockchain.

It is more common to find cases where technology ends up being a problem, and people start to talk about going back to traditional governing methods. Such is the case of Guatemala, where an unexpected design error in the Web3 governance protocol widened the gap between the poor and the rich.

The corrupt credit-based voting system faultily considered all the possible long-term cases of proof-of-social-participation. Those at the top saw how their decision power and wealth increased while those in need of resources fell into extreme poverty.

This has become so important that many academics have decided to focus on it. Many young people choose to study anything related to decentralized forms of government.

The Solution is Worse than the Problem

After the massive adoption of cryptocurrencies, the energy consumption of irrelevant tokens increased worldwide. Given the poor economic conditions, regulators could do little, so they incentivized more and more the development of new versions and features for tokens with the hope of invigorating the economy.

Unfortunately, climate change pressures and the oversupply of tokens end up in a collapse of the energy supply, and with that, the price of energy went up. This price increase resulted in lower demand for digital tokens and negatively impacted the mining activity necessary to maintain cryptocurrencies safe through the proof-of-work and the proof-of-stake protocols.

As a result of the collapse of the security of blockchain networks, an army of hackers attacked various system vulnerabilities. They focused on a vulnerability in some smart contracts where users that exchanged tokens could ask for reimbursements, stealing their tokens. After this attack, millions of users lose trust in the supposedly secure token systems. People start selling en masse, increasing the panic and turning this situation into a vicious and bloody cycle for many.

It is the end of Supatrupa and its tokenized addiction empire, dragging with it banks’ gamified economy and millions of youth and adults.

A new economic depression arose nine years after the previous one. This was the result of the bankruptcy of various Web3 projects. Large amounts of capital were lost, and even worse, the spirit of an entire generation that believed in technology as a solution to humanity’s problems became compromised.

Some radical anti-technological movements emerged as a result. They demand that technology be restrained to very specific aspects of human life and that there be a system specialized in expanding the capabilities of individuals. For these groups, technology is not the solution to our problems.

After a long period of failed innovations, governments and private companies finally gave up on using decentralized Web3 technologies to solve their problems.

Many promises were made to save the world using blockchain technology, but the global collapse of biodiversity now seems unstoppable. Although Blockchain was helpful for certain things, designers, developers, investors, and policymakers did not consider giving it an intentional focus on sustainability. The technology fell very short of their expectations.